Unlocking Assurance: Understanding Title Insurance in South Carolina Home Purchases

Embarking on the journey of homeownership is an exciting venture, yet it comes with a myriad of considerations and safeguards to ensure a smooth transition. One such crucial element often discussed in real estate transactions is title insurance. In this blog post, we unravel the concept of title insurance, demystifying its importance and exploring whether it's a necessity when buying a home in South Carolina. What is Title Insurance? At its core, title insurance is a safeguard that protects both homebuyers and lenders from potential issues related to the property's title. A property's title is a legal document indicating ownership and the absence of outstanding claims or liens that could jeopardize the buyer's rights to the property. Why is Title Insurance Necessary? Protection Against Undisclosed Issues: Title insurance provides coverage for undisclosed defects, liens, or other encumbrances that might not be apparent during the initial stages of the home-buying process. Legal Ownership Assurance: It assures the buyer and the lender that the seller has the legal right to transfer ownership and that there are no legal disputes or claims against the property. Financial Security: In the event of a title-related issue emerging after the purchase, title insurance can save the homeowner from financial loss by covering legal expenses and potential damages. Lender Requirements: While lender's title insurance is typically required to secure a mortgage, it's equally advisable for homebuyers to consider owner's title insurance for comprehensive protection. Do I Need Title Insurance When Buying a Home in South Carolina? In South Carolina, title insurance is not legally required, but its significance in a real estate transaction cannot be overstated. While some buyers may initially question the necessity of title insurance, the potential risks associated with undiscovered title defects make it a prudent investment. Key Considerations for South Carolina Homebuyers: Legal Protections: Title insurance offers legal protections that go beyond a traditional property survey, ensuring that the buyer has clear ownership and rights to the property. Peace of Mind: Investing in title insurance provides peace of mind, allowing homebuyers to enjoy their new property without the lingering concern of unforeseen legal challenges. Potential Savings: While it involves an upfront cost, title insurance can potentially save significant amounts in legal fees and financial losses that may arise from title-related issues. An Investment in Security In the dynamic landscape of real estate, title insurance stands as a valuable investment in security for South Carolina homebuyers. While not mandatory, its protective features provide a safety net against potential legal complications that could otherwise disrupt the joy of homeownership. Ultimately, the decision to secure title insurance is a proactive step toward ensuring a smooth and worry-free transition into your new home.

Navigating the Waters: Understanding Flood Insurance in South Carolina

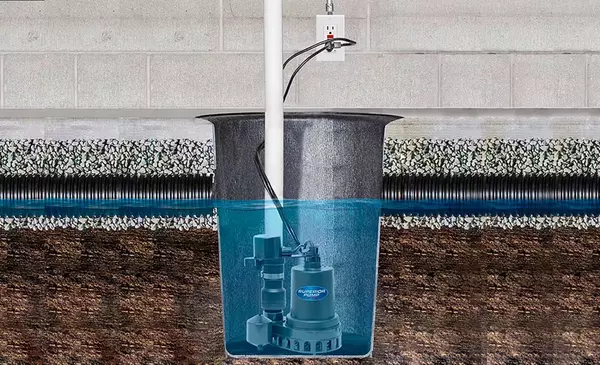

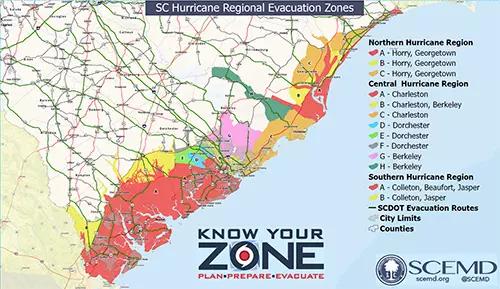

Nestled within the picturesque landscapes of the Palmetto State, South Carolina's charming coastal areas and riverfront communities come with the potential risk of flooding. In this blog, we delve into the importance of flood insurance for residents in South Carolina, exploring the nuances, benefits, and essential considerations to safeguard homes and properties against the unpredictable forces of nature. 1. Coastal Beauty and Flood Risk South Carolina's coastal allure is undeniable, but living in proximity to water bodies brings the inherent risk of flooding. Coastal storms, heavy rainfall, and storm surges are factors that can lead to flooding, making flood insurance a crucial component of homeownership in the state. 2. The National Flood Insurance Program (NFIP) The primary avenue for securing flood insurance in South Carolina is through the National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA). NFIP provides coverage for both residential and commercial properties, offering protection against flood-related damages. 3. Understanding Flood Zones Flood insurance rates are often influenced by a property's location within designated flood zones. FEMA categorizes flood zones based on the likelihood of flooding, with some areas carrying a higher risk than others. Understanding the flood zone of your property is a key factor in determining insurance rates and coverage needs. 4. Coverage Essentials: What Flood Insurance Includes Flood insurance typically covers structural damage to a property, including the building foundation, walls, flooring, and major systems such as electrical and plumbing. Additionally, coverage may extend to essential personal belongings within the property. It's crucial to review policy details to understand the extent of coverage. 5. Community Rating System (CRS) Discounts Some South Carolina communities actively participate in the Community Rating System (CRS), a FEMA initiative rewarding communities for effective floodplain management. Homeowners in CRS-participating communities may be eligible for insurance premium discounts, reflecting the community's commitment to flood risk reduction. 6. Mitigation Measures for Lower Premiums Implementing mitigation measures can contribute to lower flood insurance premiums. Elevating the property, installing flood vents, and other structural improvements that reduce flood risk may make homeowners eligible for reduced rates. Consult with insurance providers and local authorities to explore mitigation options. 7. Consultation with Insurance Professionals Navigating the complexities of flood insurance requires expertise. Homeowners in South Carolina are encouraged to consult with insurance professionals familiar with the state's flood risks and regulations. These professionals can help tailor policies to individual needs, ensuring comprehensive coverage against potential flooding events. Protecting Homes, Preserving Peace of Mind Flood insurance in South Carolina is not just a precaution; it's a proactive step toward protecting homes and preserving peace of mind for residents in flood-prone areas. As coastal and riverside communities continue to flourish, understanding the nuances of flood insurance becomes paramount. By embracing comprehensive coverage, residents can weather the unpredictable forces of nature while enjoying the beauty and tranquility that South Carolina's waterside living offers.

Seaside Serenity: Embracing Waterside Living in Mount Pleasant, SC

Nestled along the scenic shores of the Charleston Harbor and the tranquil waters of the Wando River, Mount Pleasant, South Carolina, beckons residents to embrace a lifestyle defined by waterside serenity. In this blog, we explore the unparalleled joys and unique experiences of living on the water in Mount Pleasant, where each day unfolds against the backdrop of gentle tides and breathtaking vistas. 1. Waterfront Residences: Your Personal Oasis Imagine waking up to the soothing sounds of lapping waves and the gentle rustling of marsh grass. Waterfront residences in Mount Pleasant offer a unique blend of luxury and natural beauty. From elegant waterfront estates to modern condominiums, residents have the opportunity to call the water's edge their home, with unobstructed views and direct access to the water. 2. Nautical Adventures at Your Doorstep Living on the water in Mount Pleasant means having instant access to a myriad of nautical adventures. Whether you're an avid sailor, kayaker, or simply love a leisurely cruise, the marinas and waterways of Mount Pleasant invite you to embark on aquatic escapades. Explore hidden coves, cruise along the Intracoastal Waterway, or set sail for a sunset cruise with loved ones. 3. Culinary Delights by the Water Mount Pleasant's waterside living extends to its vibrant culinary scene. Waterfront restaurants along Shem Creek and the Charleston Harbor offer not just exquisite cuisine but also panoramic views of the water. Savor the catch of the day while the sun dips below the horizon, casting a warm glow on the marshes and sailing boats. 4. Coastal Community Connection Living on the water in Mount Pleasant means being part of a tight-knit coastal community. Waterfront neighborhoods foster a sense of camaraderie as residents share a common appreciation for the beauty that surrounds them. Community events, waterfront festivals, and neighborhood gatherings become cherished moments for forging connections and celebrating the coastal lifestyle. 5. Serene Retreats and Nature's Symphony The water in Mount Pleasant isn't just a backdrop; it's an integral part of daily life. Nature reserves, marshland trails, and waterfront parks provide residents with serene retreats. Stroll along the Waterfront Park, birdwatch in the marshes, or simply relax on your porch, taking in the symphony of nature—the gentle lapping of waves, the call of seabirds, and the rustle of palmetto fronds. A Life Unveiled by the Tides Living on the water in Mount Pleasant is not just a choice; it's a lifestyle that immerses residents in the tranquility and beauty of coastal living. Whether you're drawn to the romance of sunrise over the harbor, the thrill of sailing under a Carolina blue sky, or the simple joy of waterfront gatherings, Mount Pleasant invites you to experience a life unveiled by the tides—a life where every day is touched by the magic of living on the water.

Categories

- All Blogs (78)

- 1031 exchange (2)

- 2024 market (1)

- 55 and over community (1)

- activities (2)

- african american (2)

- ai (1)

- ai design (1)

- angel oak tree (2)

- antebellum (2)

- assisted living (1)

- authors (1)

- blue bottle tree (1)

- boating (2)

- books about the lowcountry (1)

- boone hall (2)

- bulls island (2)

- buyer (8)

- buying (21)

- buying a home (20)

- buying in mount pleasant (6)

- buying in the lowcountry (6)

- buying on the water (4)

- cad (1)

- canoeing (1)

- charleston (30)

- charleston county (15)

- charleston tax (2)

- chart a boat (1)

- childhood home (1)

- climate change (1)

- coastal design (1)

- coastal erosion (1)

- coastal kitchen (1)

- coffee (1)

- coffee shops in charleston (1)

- condos (1)

- culinary (1)

- cypress gardens (1)

- design (2)

- dewees island (1)

- dock (2)

- docklife (1)

- downtown charleston (1)

- drayton hall (2)

- elderly couple (1)

- estate (1)

- farmers markets (1)

- flowers (1)

- folklore (1)

- folly beach (3)

- folly river (1)

- food (1)

- forestland (1)

- Fourth of July in Charleston (1)

- garden (1)

- gardening (1)

- georgian (1)

- greater charleston (5)

- greek revival (1)

- green thumb (1)

- greenhouse (1)

- gullah (1)

- haint blue (1)

- heirs' property (1)

- high water (1)

- historic architecture (1)

- historical homes (2)

- history (1)

- hoa fees (1)

- home buying (8)

- home repair (3)

- home styles (1)

- homeowner (6)

- homeownership (6)

- homes for sale in charleston (1)

- homes for sale in james island (1)

- homes for sale in mount pleasant (1)

- homes for sale in west ashley (1)

- homestead (1)

- homestead exemption (1)

- hospitality (1)

- hostess (1)

- hosting (1)

- houses (1)

- hurricane (1)

- insulation (1)

- interior decor (3)

- interior design (2)

- interiordesign (1)

- intracoastal (3)

- investing (1)

- investment (2)

- investment property (1)

- isle of palms (3)

- italiante (1)

- james island county park (1)

- john's island (1)

- kayaking (1)

- kitchen design (2)

- kitchen layout (1)

- land in common (1)

- lighthouse (1)

- lighthouses (1)

- lowcountry (10)

- luxury (1)

- luxury real estate (1)

- magnolia plantation (2)

- marketing (2)

- marketingyourhome (1)

- marsh (1)

- mold (1)

- mold in homes (1)

- mold in the lowcountry (1)

- mold remediation (1)

- mount pleasant (5)

- moving (3)

- moving to charleston (5)

- movingoutofstate (1)

- movingtocharleston (2)

- nar (1)

- nar lawsuit (1)

- nautical (1)

- oak trees (1)

- paddleboarding (1)

- palm trees (1)

- palmetto (1)

- palmetto trees (1)

- plantation (1)

- plantations (2)

- property (1)

- property preservation (1)

- raised homes (1)

- real estate (7)

- realestate (2)

- realestatemarketing (1)

- realty (6)

- realty101 (1)

- regime fees (1)

- relocation (1)

- relocationcosts (1)

- remediation (1)

- rental (1)

- rental properties (1)

- restaurant week (1)

- restaurants (1)

- retirement (1)

- sailing (1)

- seller (3)

- selling (10)

- selling a home (3)

- selling in charleston (4)

- selling in mount pleasant (2)

- selling on the water (1)

- selling your home (5)

- sellingyourhome (1)

- senior citizen (1)

- senior citizens (1)

- senior living (1)

- shark tooth (1)

- shem creek (2)

- south (1)

- south carolina (4)

- south of broad (1)

- southern architecture (1)

- southern folklore (1)

- southern hospitality (1)

- southern lady (1)

- southern living (2)

- spanish moss (1)

- spray foam (1)

- spray foam insulation (1)

- sullivans island (2)

- sweetgrass (1)

- sweetgrass baskets (1)

- taxes (1)

- tidal (1)

- title (2)

- title insurance (1)

- tour (1)

- tour times (1)

- townhomes (1)

- useanagent (1)

- victorian (1)

- wando river (1)

- water views (1)

- waterways (2)

- whyagentsmatter (1)

- winter (1)

- winter maintenance (1)

- winter ready (1)

- winterize (1)

Recent Posts