Navigating the 1031 Exchange: Unveiling the Basic Rules for a Successful Transaction

Categories

- All Blogs (78)

- 1031 exchange (2)

- 2024 market (1)

- 55 and over community (1)

- activities (2)

- african american (2)

- ai (1)

- ai design (1)

- angel oak tree (2)

- antebellum (2)

- assisted living (1)

- authors (1)

- blue bottle tree (1)

- boating (2)

- books about the lowcountry (1)

- boone hall (2)

- bulls island (2)

- buyer (8)

- buying (21)

- buying a home (20)

- buying in mount pleasant (6)

- buying in the lowcountry (6)

- buying on the water (4)

- cad (1)

- canoeing (1)

- charleston (30)

- charleston county (15)

- charleston tax (2)

- chart a boat (1)

- childhood home (1)

- climate change (1)

- coastal design (1)

- coastal erosion (1)

- coastal kitchen (1)

- coffee (1)

- coffee shops in charleston (1)

- condos (1)

- culinary (1)

- cypress gardens (1)

- design (2)

- dewees island (1)

- dock (2)

- docklife (1)

- downtown charleston (1)

- drayton hall (2)

- elderly couple (1)

- estate (1)

- farmers markets (1)

- flowers (1)

- folklore (1)

- folly beach (3)

- folly river (1)

- food (1)

- forestland (1)

- Fourth of July in Charleston (1)

- garden (1)

- gardening (1)

- georgian (1)

- greater charleston (5)

- greek revival (1)

- green thumb (1)

- greenhouse (1)

- gullah (1)

- haint blue (1)

- heirs' property (1)

- high water (1)

- historic architecture (1)

- historical homes (2)

- history (1)

- hoa fees (1)

- home buying (8)

- home repair (3)

- home styles (1)

- homeowner (6)

- homeownership (6)

- homes for sale in charleston (1)

- homes for sale in james island (1)

- homes for sale in mount pleasant (1)

- homes for sale in west ashley (1)

- homestead (1)

- homestead exemption (1)

- hospitality (1)

- hostess (1)

- hosting (1)

- houses (1)

- hurricane (1)

- insulation (1)

- interior decor (3)

- interior design (2)

- interiordesign (1)

- intracoastal (3)

- investing (1)

- investment (2)

- investment property (1)

- isle of palms (3)

- italiante (1)

- james island county park (1)

- john's island (1)

- kayaking (1)

- kitchen design (2)

- kitchen layout (1)

- land in common (1)

- lighthouse (1)

- lighthouses (1)

- lowcountry (10)

- luxury (1)

- luxury real estate (1)

- magnolia plantation (2)

- marketing (2)

- marketingyourhome (1)

- marsh (1)

- mold (1)

- mold in homes (1)

- mold in the lowcountry (1)

- mold remediation (1)

- mount pleasant (5)

- moving (3)

- moving to charleston (5)

- movingoutofstate (1)

- movingtocharleston (2)

- nar (1)

- nar lawsuit (1)

- nautical (1)

- oak trees (1)

- paddleboarding (1)

- palm trees (1)

- palmetto (1)

- palmetto trees (1)

- plantation (1)

- plantations (2)

- property (1)

- property preservation (1)

- raised homes (1)

- real estate (7)

- realestate (2)

- realestatemarketing (1)

- realty (6)

- realty101 (1)

- regime fees (1)

- relocation (1)

- relocationcosts (1)

- remediation (1)

- rental (1)

- rental properties (1)

- restaurant week (1)

- restaurants (1)

- retirement (1)

- sailing (1)

- seller (3)

- selling (10)

- selling a home (3)

- selling in charleston (4)

- selling in mount pleasant (2)

- selling on the water (1)

- selling your home (5)

- sellingyourhome (1)

- senior citizen (1)

- senior citizens (1)

- senior living (1)

- shark tooth (1)

- shem creek (2)

- south (1)

- south carolina (4)

- south of broad (1)

- southern architecture (1)

- southern folklore (1)

- southern hospitality (1)

- southern lady (1)

- southern living (2)

- spanish moss (1)

- spray foam (1)

- spray foam insulation (1)

- sullivans island (2)

- sweetgrass (1)

- sweetgrass baskets (1)

- taxes (1)

- tidal (1)

- title (2)

- title insurance (1)

- tour (1)

- tour times (1)

- townhomes (1)

- useanagent (1)

- victorian (1)

- wando river (1)

- water views (1)

- waterways (2)

- whyagentsmatter (1)

- winter (1)

- winter maintenance (1)

- winter ready (1)

- winterize (1)

Recent Posts

Thanksgiving Dinner Out: Where to Enjoy a Festive Feast in Charleston

Exploring Curtain Styles and Window Treatments

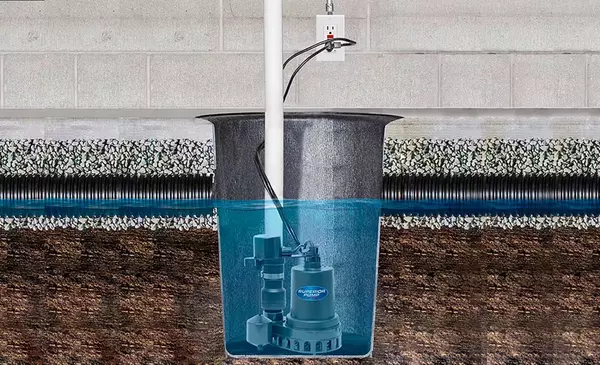

A Guide to Different Types of Sump Pumps for Residential Homes: What They Are and Where the Water Goes

The Pirates of Folly Beach, SC: A Tale of History, Mystery, and Legends

A Guide to Different Types of Ceilings in Residential Homes

Statement on Recent NAR Lawsuit Changes Affecting Home Buyers

A Guide to Short Term Rentals in Charleston, SC

Exploring the Golf Courses of Charleston and Surrounding Areas

Celebrating the 4th of July 2024 in Charleston: A Guide to Festivities and Activities

Condos vs. Townhomes in South Carolina: Understanding the Differences

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "